Think You Need Hard Money?

We Have Soft Terms.

As a private asset-based private lending partner, we provide creative financing solutions

for real estate investors, operators and developers across the country.

New Paragraph

Fast Funding, Flexible Terms and Exceptional Service

A Business Growth Strategy

Expand Your Existing Business

If you already are in need of investment and small commercial property loans. SellYouMoney provides an alternative, non-bank contingency plan for borrowers who don’t qualify for traditional bank financing. Indeed, having a secondary source of funding in your arsenal for the estimated 35-percent of investment and commercial property loans that don’t qualify for traditional bank financing is a good business strategy for investors, particularly if that lender can provide the flexibility to meet the unique needs of your projects. SellYouMoney will find the “right loan” for each borrower. Doing so earns them the reputation as a trusted lender who helps clients overcome their business challenges through the creative use of multiple real estate financing solutions.

-

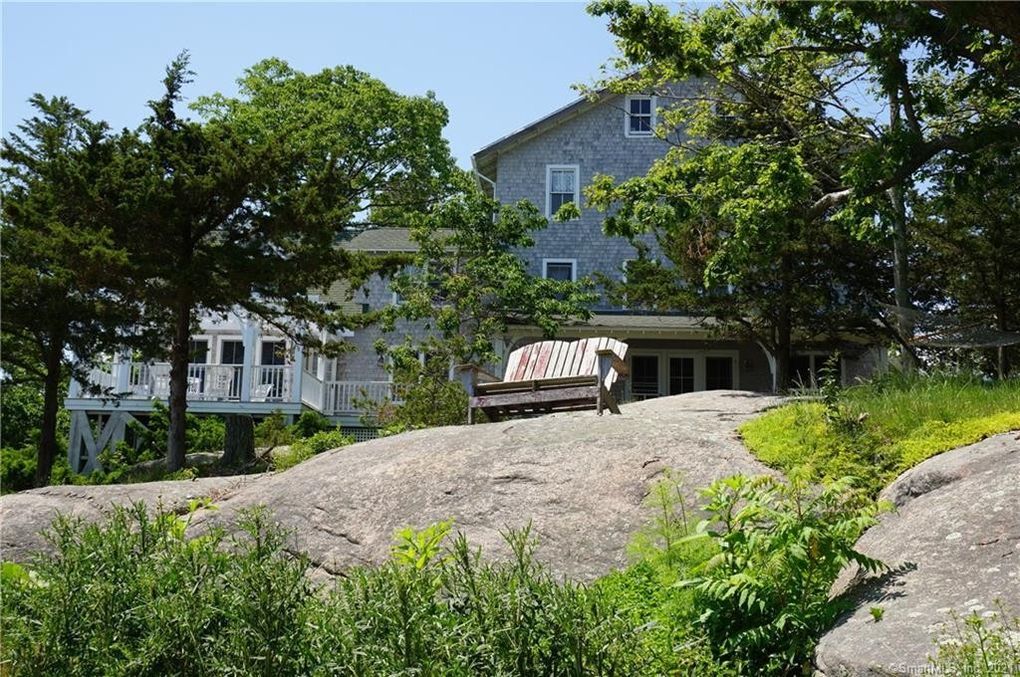

Recent Projects

More Projects Coming Soon!Every project comes with its own needs and challenges. Tell us your priorities, and we'll fill them to your satisfaction.

Contact Us Today!!

Services

OUR PROMISE

Best Rates & Fees

FLEXIBLE LOAN PROGRAMS

ROBUST TECHNOLOGY

ON-TIME, FAST CLOSINGS

EASY APPLICATION

DEDICATED ACCOUNT REP

Testimonials

M. Yehia

I would like to to thank you so much for helping me refinance my NJ property.

You guys were professional, fast and reliable. Your staff was on point with all the promises, timelines and you delivered them all.

I will be sure to work with you again soon and will be sure to recommend you to my network.

Barbara D.

We were supposed to close in June with a broker and the deal never funded. My property was listed for auction and I was sure I was going to lose my property. SellYouMoney came in and took over my situation. Recommended the auction to be delayed via legal means and closed the loan a month later even with this horrible situation! I was really impressed with their industry experience and ability to dive deep into my deal. After my first conversation, I ended up learning more about the deal than I ever knew. You saved my commercial property and gave us a great 30 year mortgage and we never have to worry about this again.